Posted: 6/19/2019 | June 19th, 2019

Last month, I announced the release of my next book, Ten Years a Nomad: A Traveler’s Journey Home.

It’s about how I became a traveler, my life as a backpacker, all the lessons I learned, and what those lessons mean for travelers. It features stories I’ve never told and goes deeper into my philosophy on travel than I ever have on this blog.

This book follows the “emotional” journey of a trip around the world: getting the bug, the planning, setting off, the highs, the lows, the friends, what happens when you come back — and the lessons and advice that come with all that.

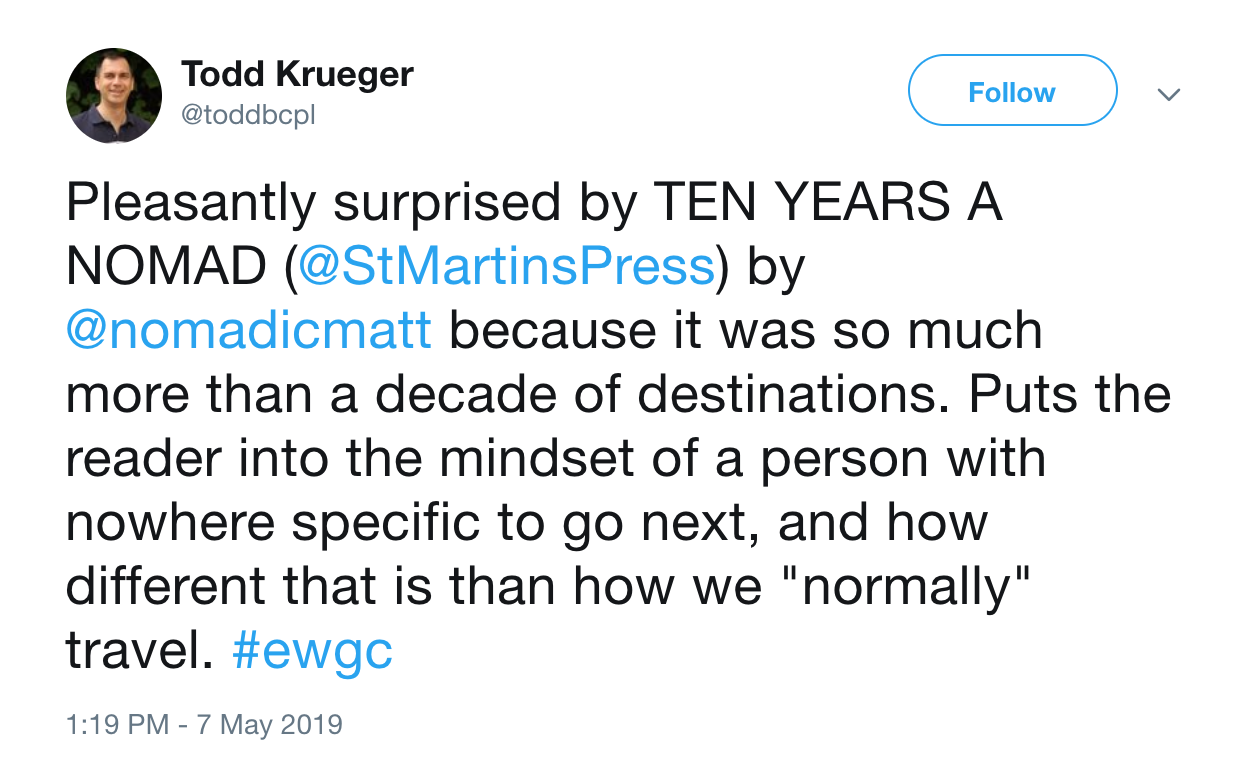

And the early reviews have been pretty good!

“In his heartfelt explanation and exploration, Matt runs through just why he’s been out there, backpacking the world for 10 years. By the end we’ve definitely realized, like Matt, how important travel is and how getting out there, on the road, can make you, me and the world a better place. It’s a great pity certain people at the very top of the world’s power pyramid never had just a little taste of the nomadic experience.” – Tony Wheeler, founder of Lonely Planet

“In his heartfelt explanation and exploration, Matt runs through just why he’s been out there, backpacking the world for 10 years. By the end we’ve definitely realized, like Matt, how important travel is and how getting out there, on the road, can make you, me and the world a better place. It’s a great pity certain people at the very top of the world’s power pyramid never had just a little taste of the nomadic experience.” – Tony Wheeler, founder of Lonely Planet

“Throughout his ruminations on how travel affected him, Kepnes interweaves his tales of friends, girlfriends, and great loves discovered among exotic backdrops and how starting a blog (nomadicmatt.com) about his adventures altered the way he traveled. His story is one of heartbreak, self-discovery, and the constant travel itch he had to scratch in order to become the man he was supposed to be. An entertaining, quick read by a man who did what many of us only dream about.” – Kirkus Book Reviews

The book comes out July 16th and I’ll be doing a book tour across the United States and Canada over the course of the summer!

If you want to join the book tour, here are our dates:

Ten Years a Nomad Book Tour

| July 16 | New York, NY: The Strand Bookstore @ 7pm | EVENT DETAILS |

| July 17 | Boston, MA: The Harvard Coop @ 7pm | EVENT DETAILS |

| July 18 | Philadelphia, PA: Penn Book Center @ 6:30pm | EVENT DETAILS |

| July 22 | Washington DC: Politics and Prose at the Wharf @ 7pm | EVENT DETAILS |

| July 23 | Miami, FL: Books & Books @ 8pm | EVENT DETAILS |

| July 24 | Tampa, FL: LOCATION TBD | EVENT DETAILS |

| July 30 | Detroit, MI: LOCATION TBD | EVENT DETAILS |

| July 31 | Chicago, IL: City Lit Books @ 6:30pm | EVENT DETAILS |

| August 1 | Dallas, TX: LOCATION TBD | EVENT DETAILS |

| August 5 | Austin, TX: Book People @ 7pm | EVENT DETAILS |

| August 6 | Houston, TX: Brazos Bookstore @ 6:30pm | EVENT DETAILS |

| August 7 | Denver, CO: Tattered Cover – Historic Lodo @ 7pm | EVENT DETAILS |

| August 8 | San Diego, CA: Warwick’s @ 7:30pm | EVENT DETAILS |

| August 12 | Los Angeles, CA: The Last Bookstore @ 7:30pm | EVENT DETAILS |

| August 14 | Portland, OR: Powell’s Books at Cedar Hills Crossing @ 7:30pm | EVENT DETAILS |

| August 15 | San Francisco, CA: Book Passage at Corte Madera @ 7pm | EVENT DETAILS |

| August 16 | Seattle, WA: Third Place Books @ 6pm | EVENT DETAILS |

| August 19 | Vancouver, BC: LOCATION TBD | EVENT DETAILS |

| August 22 | Calgary, AB: LOCATION TBD | EVENT DETAILS |

| August 26 | Toronto, ON: LOCATION TBD | EVENT DETAILS |

| August 28 | Montreal, QC: LOCATION TBD | EVENT DETAILS |

Hope to see you on the tour! It’s my first one in over four years and I’m very excited about it. It’s going to be a whirlwind!

And, as a reminder, I’m doing a pre-sale bonus so if you order the book in advance you can get free copies of my other books, one-on-one travel planning advice, free attendance at TravelCon, blogging courses, free hostel stays and flights, and more!

The packages are listed below. All you need to do to claim your bonuses is email me a copy of your receipt at matt@nomadicmatt.com.

The Basic Package (cost: $18, value: $48)

Purchase one copy of the book and get:

- How to Build a Travel Blog ebook (value: $9.99)

- The Ultimate Guide to Travel Hacking ebook (value: $9.99)

- 27 Ways to Be a Master Traveler PDF (value: $5)

- 50 Inspiring Travel Books and Movies PDF (value: $5)

***BEST VALUE*** The Tenner (cost: $182, value: $794)

Buy 10 copies of my book and get ALL THE ABOVE plus:

- My 12 city and country guides (value: $150)

- A signed copy of my book How to Travel the World on $50 a Day (value: $15)

- A 15-minute planning call with me (ask me anything)! (value: $200)

- The Business of Blogging course (value: $199)

The Bullseye (cost: $900, value: $2,493)

Buy 50 copies of my book and get ALL THE ABOVE plus:

- One ticket to TravelCon in Boston (value: $399)

- A 30-minute planning call with me (ask me anything)! (value: $400)

SUPER BONUS! The Centennial (cost: $1,800, value: $7,193)

Buy 100 copies of my book and get ALL THE ABOVE plus:

- Lunch on me! I’ll come to your city and we’ll have lunch on me! (limited to those in the United States and Canada) (value: $2,000)

- Round-trip airfare to TravelCon in Boston (from within the US and Canada) (value: $500)

- One additional ticket to TravelCon in Boston (value: $399)

Conversely, if you’re not a blogger and don’t care about TravelCon, you’ll get four nights at any hostel in the United States and one round-trip domestic airfare.

SUPER BONUS! The Big Kahuna (cost: $4,500, value: $19,293)

Buy 250 copies of my book and get ALL THE ABOVE plus:

- I’ll come to speak at your event for free! (value: $5,000)

- You’ll be flown to NYC (from within the US and Canada) the book launch party, put up in a hotel for two nights, and get dinner with me! (value: $3,000)

Note: All digital bonuses will be sent when you send the receipt. Travel arrangements will be worked out between you and me and are valid for six months after purchase (i.e., you have to make a booking by then).

Order the book today, get your bonuses, and share your love of travel!

Want to Help Me Spread the Word About This Book?

I’m always looking for more opportunities to talk travel. Here’s how you can help me spread the word about the new book:

Want to interview me?

If you have a blog, podcast, vlog, or Instagram channel and want to interview me about the book and travel, let me know at matt@nomadicmatt.com using the subject line “Book Interview.” I’d love to talk with you!

Are you in the media and want to cover the book?

If you work for a major media outlet and want to interview me about the book or would like to review the book, let me know at matt@nomadicmatt.com using the subject line “Media Request.”

Know anyone that I should reach out to for promotion?

If you have suggestions on people who would love a copy of this book and would be a good fit for promoting the book, let me know in the comments, or feel to email me at matt@nomadicmatt.com with the subject line “Book Promotion Help.”

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find a cheap flight by using Skyscanner or Momondo. They are my two favorite search engines because they search websites and airlines around the globe so you always know no stone is left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld as they have the largest inventory. If you want to stay somewhere other than a hostel, use Booking.com as they consistently return the cheapest rates for guesthouses and cheap hotels. I use them all the time.

Don’t Forget Travel Insurance

Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. I’ve been using World Nomads for ten years. My favorite companies that offer the best service and value are:

- World Nomads (for everyone below 70)

- Insure My Trip (for those over 70)

Looking for the best companies to save money with?

Check out my resource page for the best companies to use when you travel! I list all the ones I use to save money when I travel – and that will save you time and money too!

The post Announcing My Summer Book Tour appeared first on Nomadic Matt's Travel Site.

I’ve been using

I’ve been using